Working With Pitch Fees and Revenue Share Models

Pitch fees and revenue share models are ubiquitous in most of the hospitality industry nowadays. The only effective way to manage these agreements, is through NOQ’s unified platforms with embedded automation

There are so many elements that as a mobile food trader, you have to keep on top of. But having to work with pitch fees and revenue share is a hassle that you shouldn’t have to worry about.

Whether you’re trading at an event, food market, food hall, pop-up site, stadium, you’re getting charged either a pitch fee or a revenue share model. These rates vary, based on the site, the number of customers they’re expecting, the kind of clientele that is attending, and many other factors. The way these fees are managed, also varies.

Currently, either pitch fees are being charged upfront, or revenue share models are in place, and sometimes a combination of both:

Pitch Fees

The organisers and traders agree upon a rental/pitch fee. This is generally the sum that a you as a trader have to pay to take part in that site, and everything made from the sales, goes straight to you.

Problem: Cashflow becomes an issue, because on top of paying this upfront, ingredients still need to be bought, hardware needs to be rented, etc. Additionally, what if the pitch fee is too high and you are unable to recover those costs from the sales, and end up making a loss?

“I recently took part in an event where I was required to pay an upfront pitch fee of £15K, and only sold £4K worth of food. There is no security when it comes to working this way, and now we’re at a massive loss, as a small business.”

Festival Trader

Revenue Share

“Nearly all traders of any size want to work off a revenue share model. They often sometimes end up paying more that way, but they feel secure because if it pours with rain or the event is not successful, they’ve got that protection, so they don’t mind paying a bit more as long as there’s money coming in.”

Ryan Patrick, Commercial Director at Feast Streat

There’s two ways in which revenue share currently works:

Organisers take the money, and give traders their share

In this scenario, the organisers agree upon a commission percentage with the trader. They then provide one standardised payment solution to all the traders, and have the money go into their account, which they then divvy out to each trader.

Problem: You as a trader, lose control of your own business, by giving away your visibility on stock, what you’ve sold, and when you sold it. You then have to trust organisers on what your sales were, and wait for payments to be made, which can take up to 90 days to clear.

Traders take the money, and give the organisers their share

With this option, traders agree on a commission fee with the organisers, and are allowed take their own payment systems to the site. The money goes into the traders account, and they provide reports on their takings to the organisers, so they can invoice them for their agreed revenue share.

Problem: Organisers will likely charge higher commissions, assuming that numbers provided to them are untrustworthy. Additionally, it is a time-consuming hassle for independent traders like yourself, to manage these reports, invoicing, and payments.

In an ideal scenario for both traders and organisers, the payment distribution gets automated.

And that’s exactly how NOQ can help.

What is NOQ’s solution?

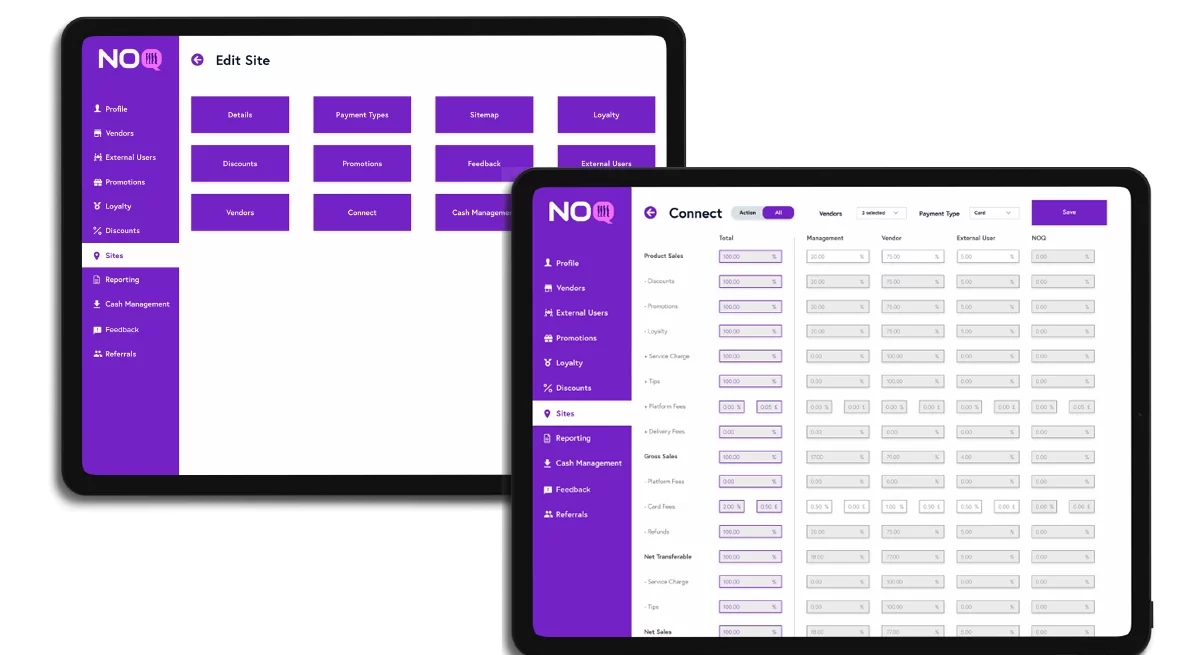

NOQ’s end-to-end management solution gets rid of all these problems. The organisers are able to create their site – event, food market, stadium – on the platform and invite multiple traders. You get access to your own platform, where you can set up your items, menus, and pricing. A unified system is used, giving organisers the visibility they need, whilst allowing traders to keep track of their sales, best and least selling items, and peak times.

The cherry on the cake is that whatever the agreed fees are, they get taken care of automatically. If working with revenue share, as soon as a payment is made, it gets distributed into each one’s account per the agreed commissions. And if you’re working with pitch fees as an overrider, the revenue distribution can take place only after you’ve hit that threshold, so you don’t incur in commissions right from the first sale.

Say goodbye to cashflow issues, invoicing, chasing for payments, and say hello to streamlined operations and full understanding of your business!

How can it work for your operations?

- If you just need a simple tool to record transactions, where you can either simply input the amount and take card and cash payments – we can help you.

- If you need to keep track of which items you’ve sold and understand your margins – we can help you.

- If you need a system that allows you to send tickets to the kitchen and the bar automatically – we can help you.

- If you need a system that you can use as a waiter pad, which then sends order to your kitchen – we can help you.

- If you need a system that allows you to take telesales for deposits or takeaway orders – we can help you.

- If you need own branded mobile ordering for click & collect, table ordering, pre-orders and a loyalty programme – we can help you.

- If you need a desktop ordering solution which integrates with your stock count – we can help you.

Our multi-purpose software is suitable for any business type. We cover a whole range of services needed to successfully run your F&B operations.